Payroll

Payroll is a cornerstone. Our intuitive technology ensures your payroll is processed efficiently and accurately. PayPros full payroll preview puts you in control and allows you to catch errors before you process. Plus, we offer a multi-layered security strategy to ensure that system access is limited to the right people.

• Real time payroll preview

• Anywhere, anytime access

• Garnishment management

• Standard payroll reports and a custom report writing tool

• Year-end administration services including W-2/1099 processing

• Fully integrated

• Automated tax filing

• Employee and manager self-service

New Paragraph

• No fee direct deposit

• Check, direct deposit or pay card payment options

• Complete payroll related tax service

• Check, direct deposit or pay card payment options

Specialized Payroll Needs

Non-Profits/Social Services/Healthcare/Manufacturing

- Customized Reports

- GL Interface

- W2 and 1099 Generation

- Labor Distribution

- Shift Differentials

- Reimbursements Listings

- Job Costing (Learn More)

- Certified Payroll (Learn More)

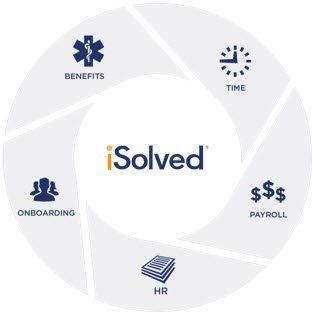

PayPros Payroll is Integrated with Time and HR

All of Your “Must Haves” in a Single solution

1. Pay employees (Payroll)

2. Collect, manage and schedule time (Time)

3. Deliver and administer benefits (Benefits)

4. Create and maintain employee records (HR)

5. Collect new hire information (Onboarding)